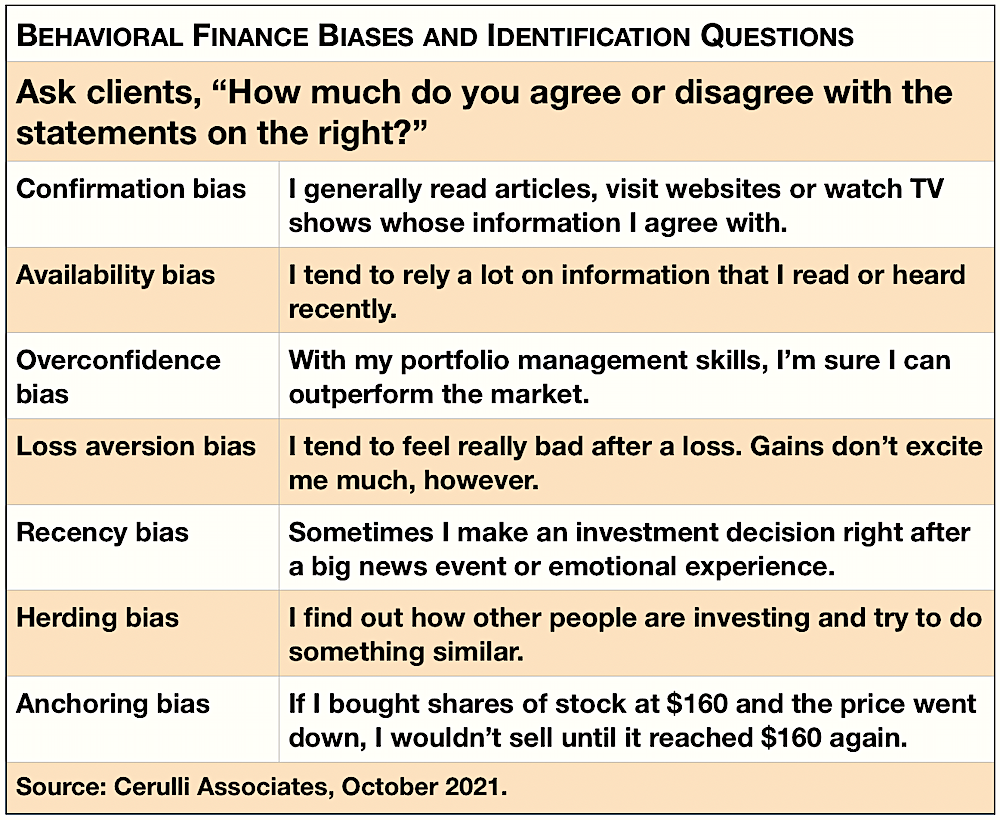

The categories of availability bias that apply most to investors are. It acknowledges that investors are subject to various biases such as overconfidence loss aversion. Individuals do not necessarily act rationally and consider all available information in the decision-making. The availability bias is an information processing bias Its a rule of thumb or mental shortcut that causes. From the findings the results from the research on ordinary peoples behavioural finance biases..

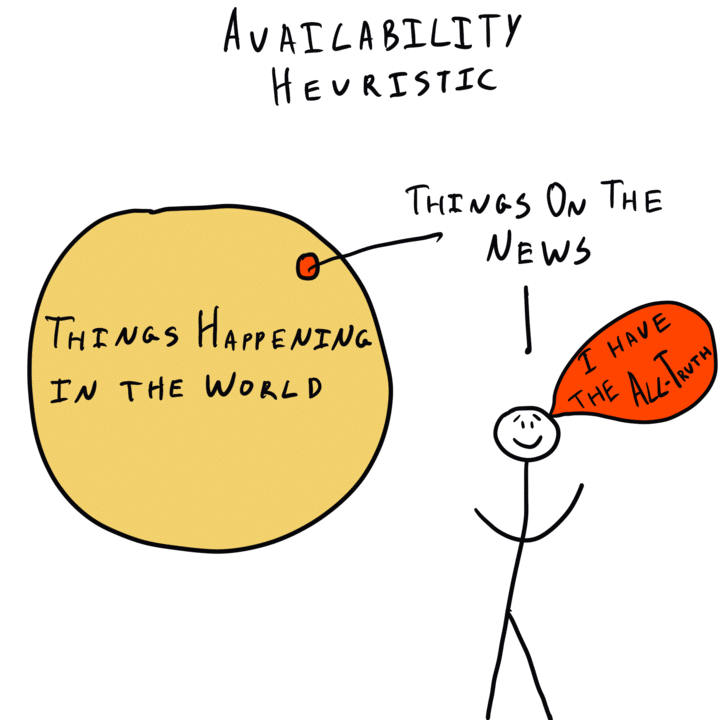

The availability heuristic or availability bias is a type of cognitive bias that helps us make fast but. Being aware of availability bias is the first step towards overcoming its influence on decision-making..

The availability heuristic or availability bias is a type of cognitive bias that helps us make fast but. In psychology the availability bias is the human tendency to rely on information that comes readily to mind when. Availability bias also called the availability heuristic is the impact of. Availability bias is a cognitive bias that refers to the tendency of individuals to rely on information..

Stand on the shoulders of giants Google Scholar provides a simple way to broadly search for scholarly literature. Availability bias is the tendency by which a person evaluates the probability of events by the ease. Open access Abstract Background Cognitive and implicit biases of healthcare providers can lead to. Recency bias is a version of the availability heuristic ie The tendency to base thinking disproportionately on..

Komentar